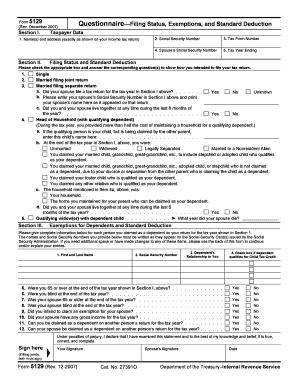

IRS 5129 2004 free printable template

Get, Create, Make and Sign

Editing irs form 5129 online

IRS 5129 Form Versions

How to fill out irs form 5129 2004

How to fill out irs form 5129:

Who needs irs form 5129:

Video instructions and help with filling out and completing irs form 5129

Instructions and Help about irs form 5129 printable

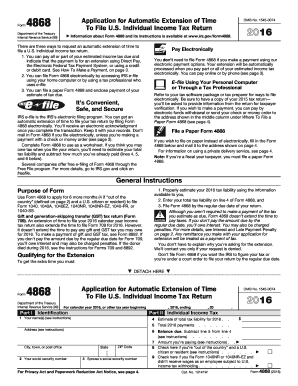

Hi in this video we'll go through how to fill out I RS form 8802 which is to request a certification for us residency for tax purposes you'll need this form so that you can prove that you are a US taxpayer we'll go through these instructions as though you or a single taxpayer who filed in April as an individual if those circumstances do not match your circumstances please email me and I can help you with your situation first you can find this form and the instructions to fill it out on the IRS website we'll go through the form itself first and then talk about payment at the end of the process, so first you're going to go to iron and in the search bar at the top of the page you can just type in 8802 and hit enter that will bring you to this results page, and you want the third link down for the actual form and that second link will give you a PDF file that explains all the parts of the form and the different options that you have so if you want to see where the information in this video came from you can look at that PDF and see where or why I'm telling you the things that I'm telling you so go ahead and click on form 8802, and it'll open up and look like this, so again we're gonna talk about payment at the end that first bar at the top there where it says electronic payment confirmation number we'll come back to that, but you want to go ahead and fill in your information so in applicants name you put in your full name including your middle and last names if you have multiple names you want to put in the entire legal name that you have there in the next box where it says applicants US taxpayer identification number that's going to be your social security number the only reason that it wouldn't be would be if you maybe have like a tax guy that used a different ID number but for most people it's your social we're going to go ahead and skip the next two boxes but if you are married, and you filed a joint return then you would put in your spouse's name your spouse's taxpayer ID and if you're filing also to get a form for tax residency for your spouse then you check that box but for most of us that's not the case, so we'll go on to line one you only need to put anything in this line if you have legally changed your name or social security number since the last time you filed taxes most people will leave line one blank in line two you're going to enter the address you used on your most recent tax filing they want you to include the country your zip code if you live in an apartment the apartment number everything next we'll go on to line three in line in 3a you're going to put where you would like that tax residency form to be mailed as well as any sort of notification mailing that they send you, so they'll send you a letter when they've received your form, and they start processing it and if they need to notify you about any problem sometimes they'll mail it to you so make sure that you enter here an address that you'd like the at the IRS to contact...

Fill form : Try Risk Free

People Also Ask about irs form 5129

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 5129 2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.